Compliance Partnerships Built to Protect Cardholder Data

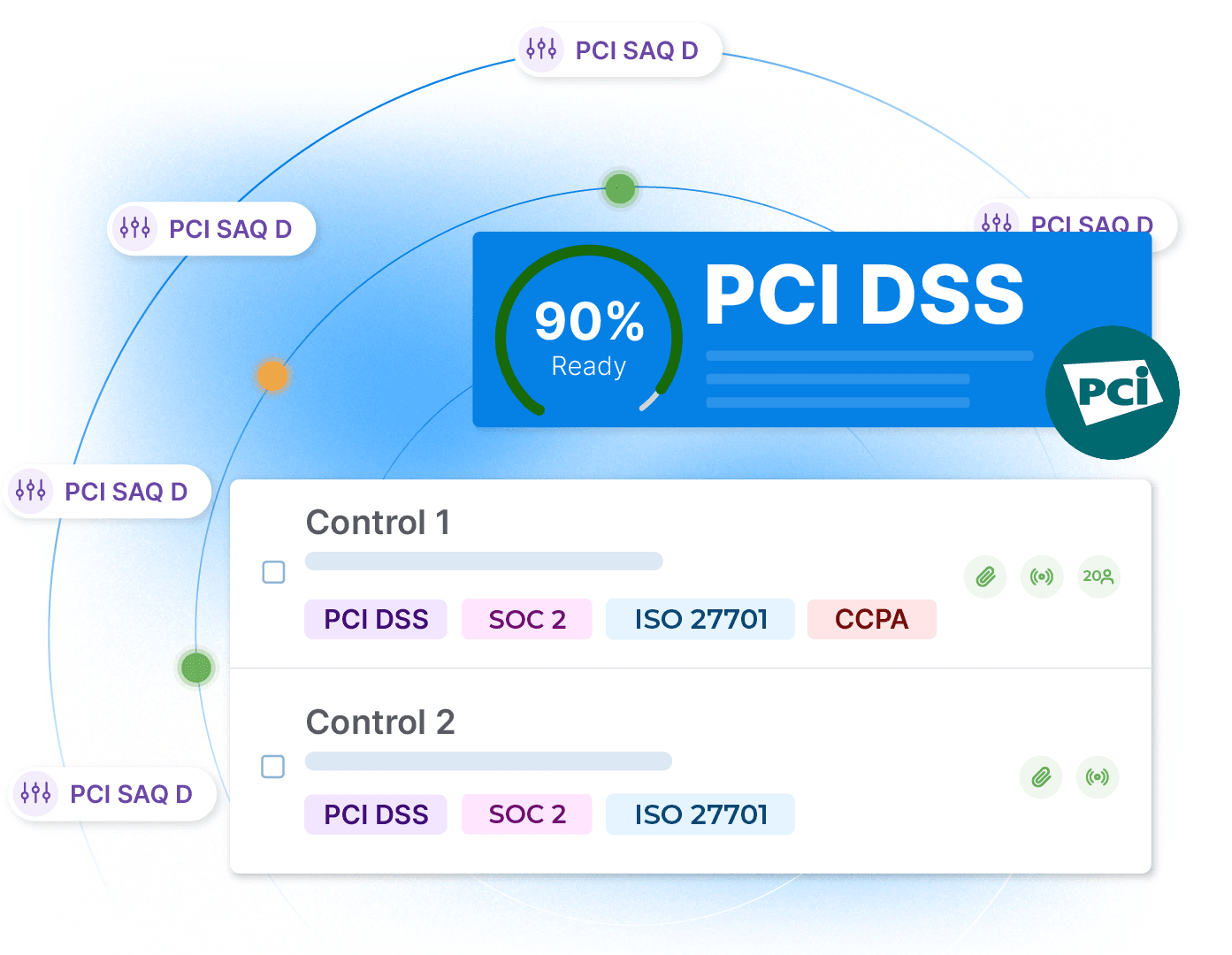

PCI DSS is a prescriptive and challenging compliance mandate that can be overwhelming. With Drata’s out-of-the-box PCI DSS SAQ aligned controls, you can accelerate your security and compliance posture. Paired with our compliance experts, Drata’s all-in-one solution gives you a step-by-step process for implementing a program that automates manual tasks.

Use a PCI Playbook to Get Compliance Ready

Drata’s built-in PCI playbook gives you the tools to quickly and easily navigate PCI DSS compliance requirements while providing teams with a single documentation source.

Our playbook of pre-mapped controls allows you to gain visibility into your security posture and control over compliance. PCI DSS pre-mapped controls help eliminate errors that standardly occur with manual tracking.

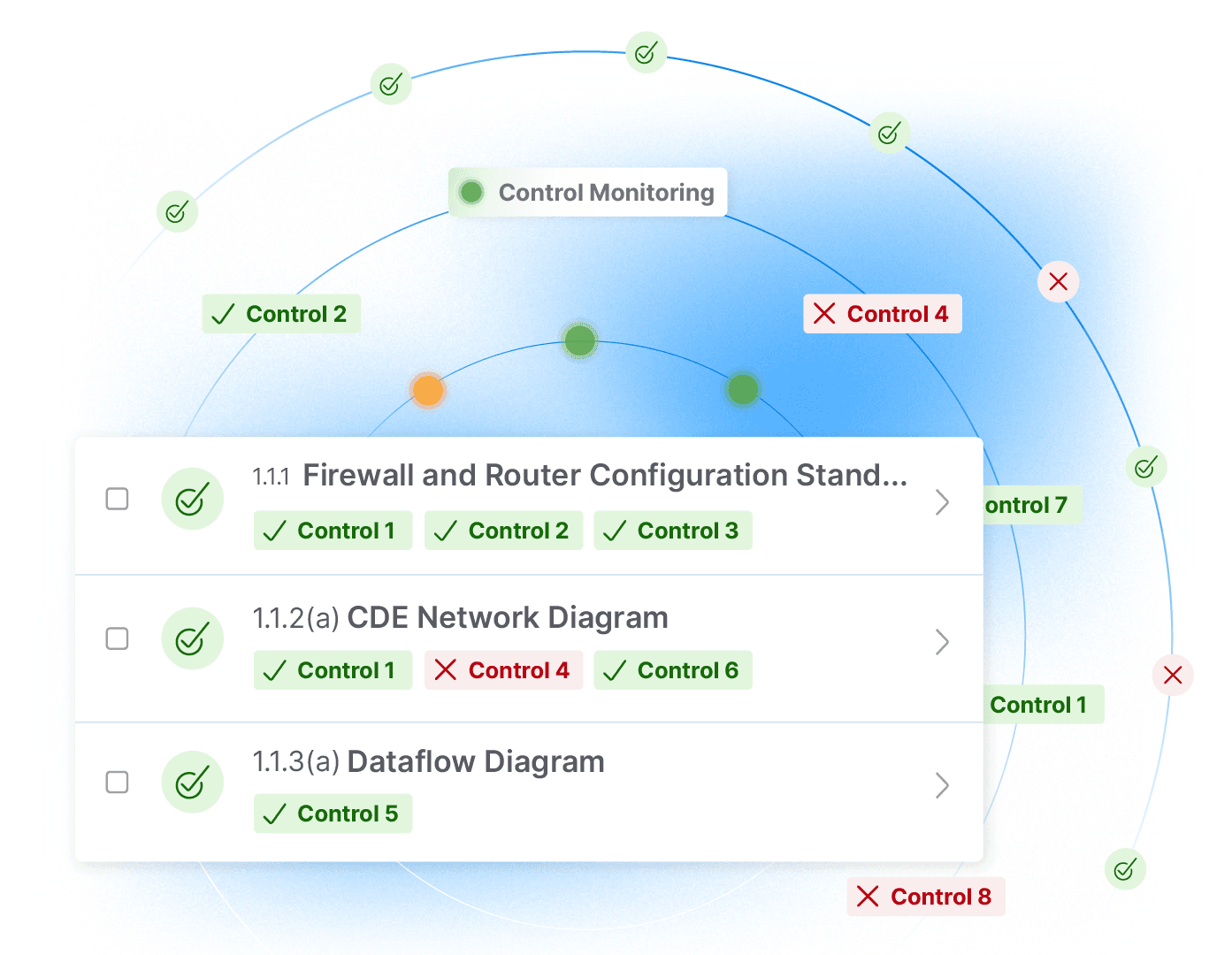

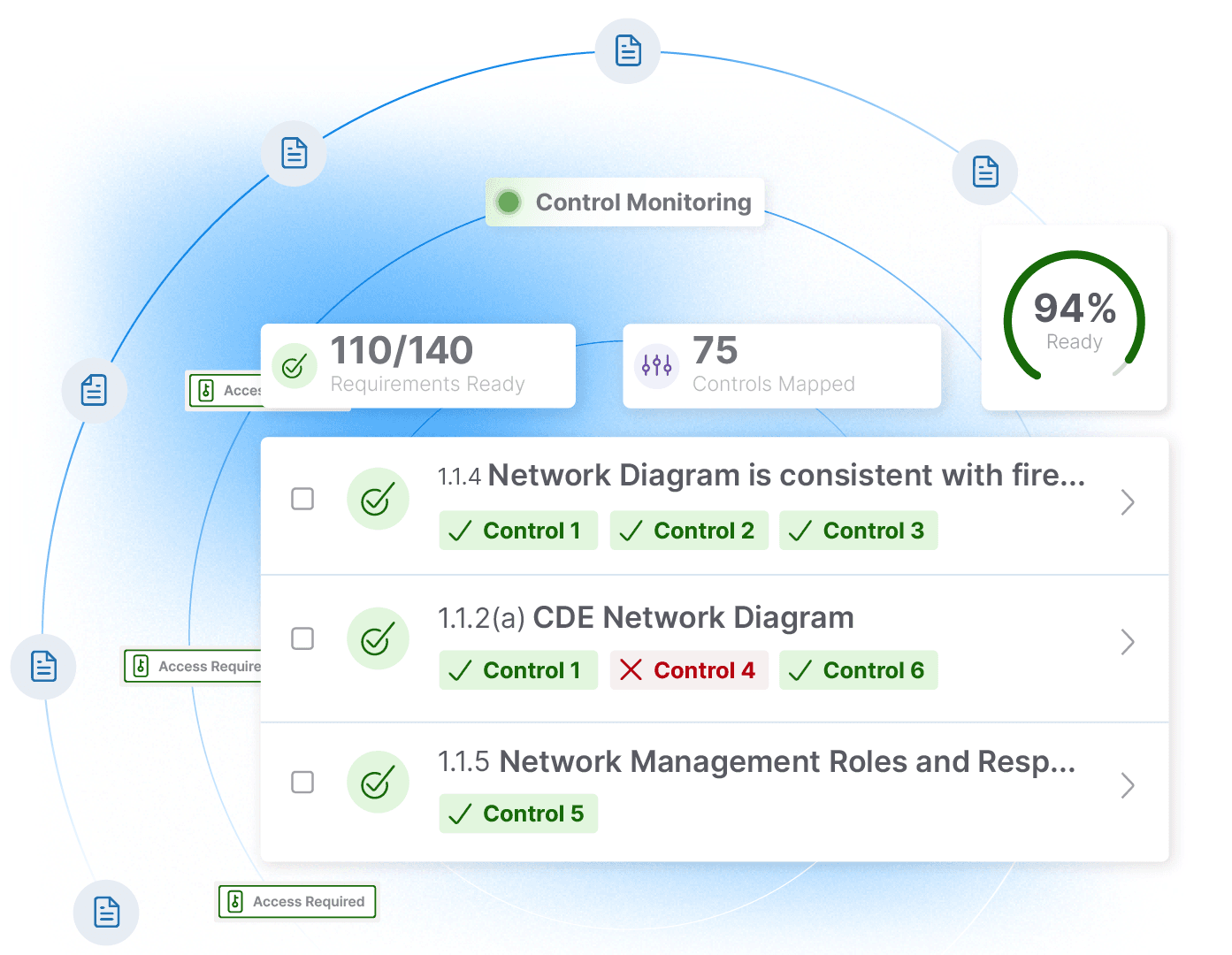

Save Time With Automation That Works for You

Say goodbye to spreadsheets. Drata’s dashboard gives you a complete view of your security posture and compliance status for PCI DSS, eliminating uncertainty. Our platform empowers you by providing pre-mapped controls, automated monitoring, evidence collection, asset tracking, and access control visibility in one place to track progress.

We also offer multiple integrations with background check tools to ensure you meet all security information policy requirements.

What's Included With PCI DSS

Everything you need to achieve, maintain, and scale your PCI DSS compliance.

Security Reports

With Drata’s real-time, shareable reports, you can communicate your security posture to customers and prospects.

Support and Live Chat

Drata’s support team consists of compliance experts and former auditors. Our experts are a click away.

Vendor Management

Drata enables you to create a centralized location for storing, sending, and reviewing security questionnaires.

Endpoint Monitoring

Drata’s built-in solution for monitoring and collecting endpoint configuration evidence streamlines compliance.

Employee Compliance View

Eliminate any uncertainty about your compliance status with our dashboard view of your security posture.

PCI DSS Controls Playbook

Drata’s platform has pre-built PCI controls and requirements to help you streamline compliance activities.

Looking For More?

Check Out the Latest GRC Resources

Blog

Introducing Automated PCI DSS Compliance

Announcing Drata’s new framework—PCI DSS. If you accept, process, store, or transmit credit card information, PCI compliance is required.

Blog

PCI DSS Compliance Checklist: Understanding the 12 Requirements

We dive into each of the 12 requirements and offer a helpful PCI compliance checklist to reference as you embark on your compliance journey.

Frequently Asked Questions About PCI DSS

Who needs to comply with PCI DSS?

PCI DSS applies to any company that handles cardholder information. Essentially, if you sell anything or accept donations by credit cards, you must comply with PCI DSS.

What is cardholder data?

Cardholder data is any information on a customer’s payment card. This includes name, Primary Account Number (PAN), service code, expiration date, and sensitive authentication data. Sensitive authentication data includes full magnetic stripe data, CAV2/CVC2/CVV2/CID, and PIN/PIN block.

Are there fines or penalties for non-compliance?

Yes. If you fail to comply with PCI DSS, payment providers can fine you anywhere from $5,000-$100,000 per month. Plus, banks can assess additional penalties, like increased transaction fees or termination of the relationship.

Automate Your Journey

Drata's platform experience is designed by security and compliance experts so you don't have to be one.

Connect

Easily integrate your tech stack with Drata.

Configure

Pre-map auditor validated controls.

Comply

Begin automating evidence collection.

Put Security & Compliance on Autopilot®

Close more sales and build trust faster while eliminating hundreds of hours of manual work to maintain compliance.