Navigating the Fintech Risk and Compliance Ecosystem

Understand risk sources, preventative measures, and the regulations impacting fintech companies to better protect your business.

Understand risk sources, preventative measures, and the regulations impacting fintech companies to better protect your business.

Fintech companies face unique risks in four primary areas: regulation, cybersecurity, financial and business, and reputation. Compliance offers a solution to today’s challenges. But what exactly are the risks that most affect fintech, and how can you proactively mitigate them?

In this comprehensive guide, you’ll learn:

Major fintech risks across four primary areas: regulation, cybersecurity, financial and business, and reputation.

How to identify and address those major fintech risks before they impact or disrupt your business.

Fintech regulations around the world so you’re prepared no matter where you do business.

How to get compliant using our two-step process.

Fill out the form and we'll send you an email with your copy.

By submitting this form I agree to receive communications (including emails) from Drata. See our Privacy Notice for more info.

Related Articles

Blog

Compliance has become table stakes for fintech. Here are six ways continuous fintech compliance programs address security and compliance risks.

Blog

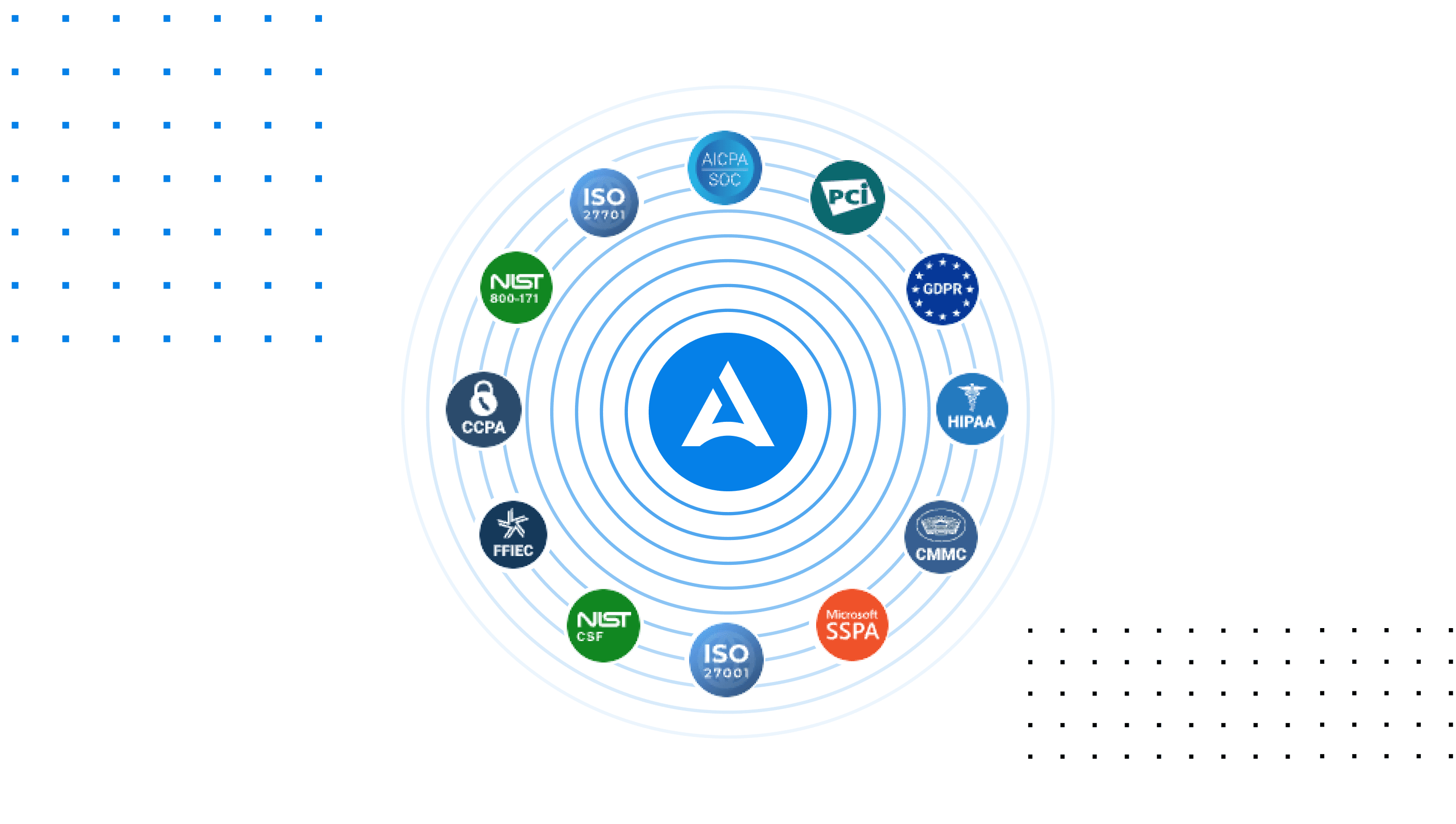

Discover details about 14 popular security frameworks and standards, why they matter, and how your organization can prove compliance.

Meet the thousands of companies that trust Drata

Automate Your Journey

Drata's platform experience is designed by security and compliance experts so you don't have to be one.

Close more sales and build trust faster while eliminating hundreds of hours of manual work to maintain compliance.