How to Effectively Calculate the Value of Compliance

Let’s walk through how you can actually calculate the value compliance brings to your business and—more importantly—how it directly impacts your bottom line.

For startups and fast-growing companies, calculating the value GRC programs bring can feel nigh impossible—especially when you're working with limited resources and a complex web of ever-changing regulations. But here’s the truth: knowing the return on investment (ROI) of compliance is crucial. It’s not just about avoiding fines or regulatory headaches. It's about unlocking long-term growth, earning customer trust, and fueling your company’s success.

Let’s walk through some ways you can actually calculate the value compliance brings to your business and—more importantly—how it directly impacts your bottom line.

Here's what our CISO Matt thinks:

Mitigating Risk to Protect Revenue

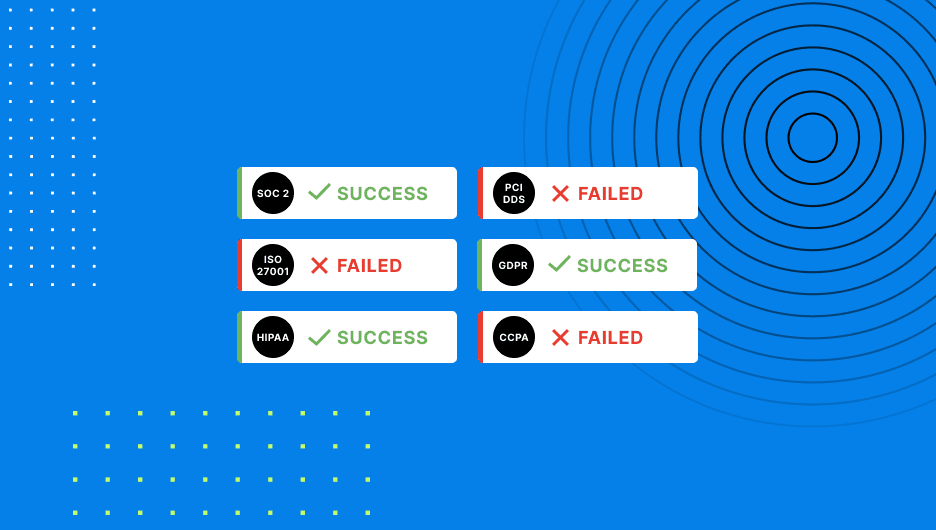

Let’s start with the most obvious benefit: reducing risk. The right compliance program ensures your company is playing by the rules—whether it’s SOC 2, ISO 27001, or GDPR—so you’re not stuck paying costly fines or suffering reputational damage. According to IBM’s 2023 Cost of a Data Breach Report, one data breach could cost your company upwards of $4.45 million globally.That’s a financial hit that could be devastating for a growing company.

The stakes are even higher if you’re a healthcare organization, where a single HIPAA violation could cost up to $50,000. A rock-solid compliance program can prevent violations and breaches like these. By proactively mitigating risks, you help protect your revenue stream and keep your operations running smoothly, rather than scrambling to fix avoidable mistakes. The more risks you manage to prevent, the more stable (and predictable) your revenue will be. That's real peace of mind.

Operational Efficiency Through Automation

Here’s where compliance gets fun: it’s not just about avoiding penalties—it can actually make your business more efficient. Automated compliance tools can drastically cut down the time your team spends managing audits, tracking risks, and keeping all your controls documented—a lifesaver for every organization, but especially if you’re part of a smaller team.

Companies that switch to compliance automation tools like Drata often report reducing their audit prep time by 75%, saving around 200 hours of labor annually. Instead of bogging down your team with repetitive compliance tasks, automation lets them focus on what really matters—like developing new products or closing more deals. This newfound efficiency doesn’t just make life easier; it boosts your profit margins by lowering operational overhead and freeing up your team to create more value for the business. All together, these efforts ultimately help build and maintain the trust of customers through predictable and favorable external assessments that customers rely on.

Using Compliance as a Competitive Differentiator: Driving Revenue Growth

Think compliance is all about paperwork? Think again! When done right, it’s one of the best ways to stand out from the competition. A solid compliance program doesn’t just build internal trust; it builds customer trust. And when you have frameworks and certifications like SOC 2 or ISO 27001, you’re showing your customers—especially B2B clients—that you take security and privacy seriously. This is a huge selling point, particularly when it comes to closing deals or expanding into new markets.

Startups in industries where trust is everything (think SaaS or fintech) can leverage these certifications to stand out from the crowd. They aren’t just badges; they’re revenue boosters. For instance, one SaaS company saw a 15% jump in contract win rates after getting their SOC 2 attestation. Why? Because potential customers viewed them as more secure and trustworthy, making them an easy choice. This increased trust doesn’t just accelerate the sales process; it can help companies charge premium rates, boosting their overall revenue in the process.

Boosting Net Retention Rate by Enhancing Customer Trust

Our CISO Matt weighed in on this:

Attracting new customers is great, but keeping the ones you have? Even better. A well-implemented compliance program doesn’t just help you bring in new business; it helps you hold onto your existing clients by building long-term trust. Customers who feel secure with you are far less likely to jump ship.

Let’s say a fintech company rolls out SOC 2 compliance and sees a 10% drop in customer churn—that’s massive. Lower churn equals a higher net retention rate (NRR), which directly boosts your profitability. After all, keeping customers is far less costly than acquiring new ones. Plus, the longer they stick around, the higher their lifetime value (LTV) becomes, providing your business with more reliable, long-term revenue.

So, what’s the bottom line? Calculating the value of compliance isn’t just about dodging fines—it’s about using those security and compliance efforts to drive real, measurable business outcomes. We’re talking about revenue growth, better retention rates, and a more efficient operation.

By linking your compliance efforts to key metrics like risk reduction, automation, certifications, customer trust, and incident response costs, you’re not just proving ROI—you’re showing that compliance is a strategic, revenue-driving asset for your business. It’s not a necessary evil; it’s a competitive edge and a critical tool for sustainable growth.